Every year, I read the top 2-3 new business books that have been published. Beyond that, I still prefer reading obscure books, titles that fly under the radar. Accordingly, here are 20 obscure business titles ranging from management to marketing to small business.

[Read more…] about Great But Unknown Business BooksConnecting the Dots between Rowing and Business with Dan Boyne

I know nothing about rowing, yet I like reading books about this sport because the necessary ingredients for success are similar in business and for the leaders who steer them to never-ending finish lines. Accordingly, CFO Bookshelf was thrilled to interview author and rowing coach, Dan Boyne.

[Read more…] about Connecting the Dots between Rowing and Business with Dan BoyneYour CEO Wants You to Know These Fundamentals

Once upon a time, every business manager and leader in a mid-sized to large company read Charan’s and Bossidy’s classic, Execution: The Discipline of Getting Things Done. However, you may have missed a gem that Charan published about a decade later.

[Read more…] about Your CEO Wants You to Know These FundamentalsPorter’s Five Forces on the Political Stage

When I saw the book, The Politics Industry, pop up in my LinkedIn feed authored by Katherine Gehl along with Michael Porter, I skimmed the viewable pages on Amazon. Brilliant content and creative – using Porter’s Five Forces on the political stage. More than brilliant – genius thinking. Within minutes, I was reaching out to Katherine Gehl on LinkedIn for an interview request.

[Read more…] about Porter’s Five Forces on the Political Stage2 CFOs Break Down the Kolbe A™ Index

Bruce and I enjoyed our recent conversation with Amy Bruske, the president of Kolbe Corporation who educated us about our conative strengths. This week, Bruce and I wanted to dive deeper into this topic because it’s practical, actionable, and predictable. We also explored why many teams are stuck and can’t get projects moving along.

[Read more…] about 2 CFOs Break Down the Kolbe A™ IndexDryrun’s Blaine Bertsch Talks Cash Flow

One of the early presidents of Sun Microsystems nearly 30 years ago said enterprise servers were like teenage sex – everybody talks about it, but no one does it right. I could say the same thing for short-term cash flow forecasting. Cash flow forecasting doesn’t need to be hard, especially when using the right tool.

[Read more…] about Dryrun’s Blaine Bertsch Talks Cash Flow2 CFOs Talk About OKRs

I enjoyed listening to last week’s podcast episode with OKR expert Ben Lamorte, the president of OKRs.com. I didn’t want the conversation to end, so I peppered my co-host with about a dozen OKR questions on this week’s show. We also hit on topics that we didn’t have time to cover last week.

[Read more…] about 2 CFOs Talk About OKRsRemembering the Best Books of 2010

Can you remember the books you’ve read a decade ago? If so, can you remember some of the key points from those books? I recently revisited my top 5 books that I read 10 years ago. You might recognize some of the titles, and four of the authors are household names. Let’s dive in.

[Read more…] about Remembering the Best Books of 2010A Patrick Lencioni Consultant on Smart and Healthy Business

If I had my own business hall of fame, Brian Jones of The Table Group would easily have his own wing. Brian was one of the first consultants to join Patrick Lencioni’s consulting arm more than 15 years ago. More importantly, Brian has helped thousands of executives and their teams.

[Read more…] about A Patrick Lencioni Consultant on Smart and Healthy BusinessAre You a CFO SmartBriefer?

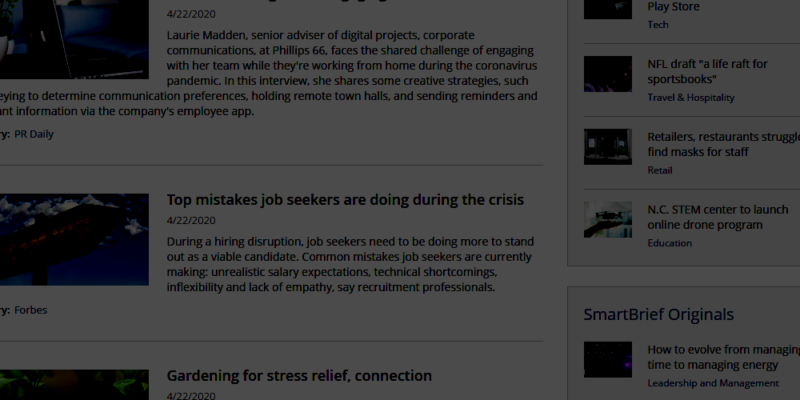

Most of us have a morning reading routine. Mine starts with reading the front page of the online WSJ reading articles that interest me. I have about 6 other sites I scan quickly drilling into stories warranting my attention. Then I check my inbox from curated content providers like SmartBrief.

[Read more…] about Are You a CFO SmartBriefer?