If you are looking for the PayPal version of Brad Stone’s, The Everything Store, that book has arrived. Jimmy Soni is the author behind The Founders where he takes us on a deep, yet informative and eye-opening journey from PayPal’s pre-startup days to just after its IPO. The book is rich with insights we’ve never heard before, and the bookends are incredible–the three-hour conversation with Elon Musk and the moving and inspiring epilogue.

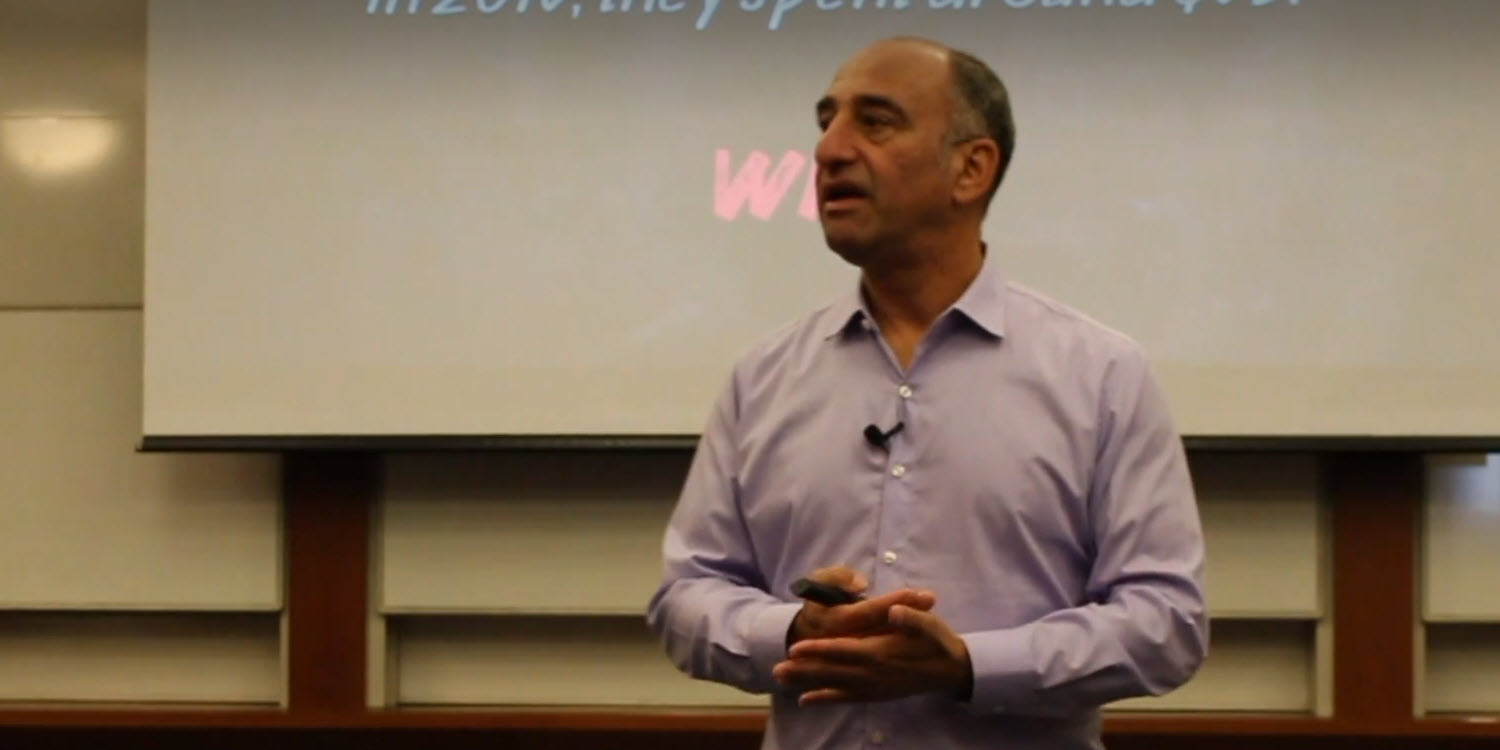

Title Photo Credit: Wikipedia Commons

Interview Highlights

- More than a twenty-minute polite conversation with Elon Musk

- The author’s biggest insight

- Everyone needs a Reed Hoffman

- Peter Thiel, the reluctant CEO with a nose for talent

- The value of Bill Harris

- Anti-fraud measures – from innocence to frustrations, to superiority

- The love-hate relationship between eBay and PayPal

- Peter Thiel’s 9/11 email

- The powerful and moving epilogue

More Big Ideas from The Founders

Regarding the Product

Great ideas start with a vision, but the product sometimes surfaces by accidents. Many times, you need an outsider to push back and ask off-the-wall questions. In this case, it was Reid Hoffman.

Musk had learned that start-up success wasn’t just about dreaming up the right ideas as much as discovering and then rapidly discarding the wrong ones.

The Founders, page 59

Regarding Leadership

Sometimes, the best leader is the one who doesn’t want to be. The professional CEO is not always the answer in a startup.

Regarding Partners and Competitors

Love-hate relationships with competitors are inevitable. Be factual when attacked.

Regarding Hairballs

When dealing with hairballs (undesirable frustrations that seemingly linger longer than you want), stay the course. Hairballs could lead to unexpected strengths down the road.

Regarding Money

It’s not only about knowing how much money to raise, but when to raise it–timing is critical, especially in Silicon Valley.

If we hadn’t raised that $100 million round, there would be no PayPal … there would be no SpaceX, no LinkedIn, and no Tesla.

The Founders, page 170

Regarding People

In startups, Topgrading is probably not the onboarding solution of choice. Instead, it’s smart friends willing to put in the long hours who connect with the vision.

We had to recruit our friends because no one else would work for us.

David Sacks, The Founders, page 74

If not us, then who? The idea that our motley crew of misfits could come together to build something out of nothing was really incredible.

Amy Row Klement quote from The Founders

Meaningful Anecdotes

No spoilers are allowed in this post, but here are some of the memorable stories you’ll find in this story:

- I had no idea what the PayPal origin story was. That meant everything about the role of PalmPilot was new to me including X.com and Confinity.

- The naming of PayPal by Master-McNeil was instructional and fascinating

- The car ride with Elon Musk and Peter Thiel seemed to come from left field, and I found it comical (Peter probably didn’t)

- I found myself wanting to learn more about the Nebraska customer service center. They are one of the unsung heroes in this story.

- We covered this in the interview, but the fraud issues that escalated as PayPal grew were frustrating, and the author’s stories and research revealed how they turned a serious problem into a strength.

- Should eBay acquire PayPal or stick with Billpoint? Find out the opinion of Howard Schultz who sat on their board.

- The evening PayPal founders flew back home from New York after meeting with Morgan Stanley

New Terminology

Every new book brings new ideas, new terms, and new words. Here are notable mentions you’ll uncover in The Founders:

- scenious

- outsized ambitions

- the best definition of product management I’ve ever heard

- producers vs product managers

- chain ladder analysis

- regicide

- mimetic desire

- diaspora movement

- PayPal PTSD

Six Things I Learned about FinTech Fraud

I’ve already mentioned some of the great stories the author brought us about fraud detection. Here are six big AHAs:

- PayPal was the first firm to scale CAPTCHA and among the first to solve the centuries-old challenge of separating human from machine.

- Fraudsters find loopholes, engineers patch, and the fraudsters start all over again.

- “Losing a lot of money was a necessary byproduct in gathering the data needed to understand the problem and build good predictive models.”

- “Taken together, PayPal turned fraud from an existential threat to one of the company’s defining triumphs. It also had the unexpected benefit of thinning out the competition.”

- PayPal achieved one of the lowest fraud rates in the financial services industry, reducing its fraud rate by several orders of magnitude by the end of 2001.

- From Cervantes, “Fraud catching is a combination of people, machine learning, and automated rules,”

I Want That Spreadsheet

I don’t think I’ll be the only financial geek to notice this in the book. Elon Musk hired Roelof Botha to build a business model for the payments business. Musk wanted to understand the banking side of the model, deposit taking, and the issuance of credit lines.

Botha then rebuilt x.com’s financial model from scratch.

Botha felt its financial modeling was “super simplistic.” He began building a more robust one using a wider set of metrics. Over time, Botha’s spreadsheet took on oracular significance—one had to consult “the model” before big decisions.

From The Founders

Wouldn’t you love to see that spreadsheet? I would.

Relevant Links

- The author’s Amazon page which includes Jimmy’s first book, A Mind at Play

- Jimmy Soni website

- Twitter account

- LinkedIn profile

Books Mentioned

The Producer’s Picks

If you like this episode, here are some similar shows:

Leave a Reply