Every action we take has potentially unintended consequences. Never has this been more true as small businesses that have been badly bloodied by the coronavirus crisis look to the Small Business Administration for relief. Options exist, but which one? That’s the question Bruce and Mark tackle on this week’s podcast.

Relevant Show Notes

Financial Buckets for Disaster Relief

Relevant Links

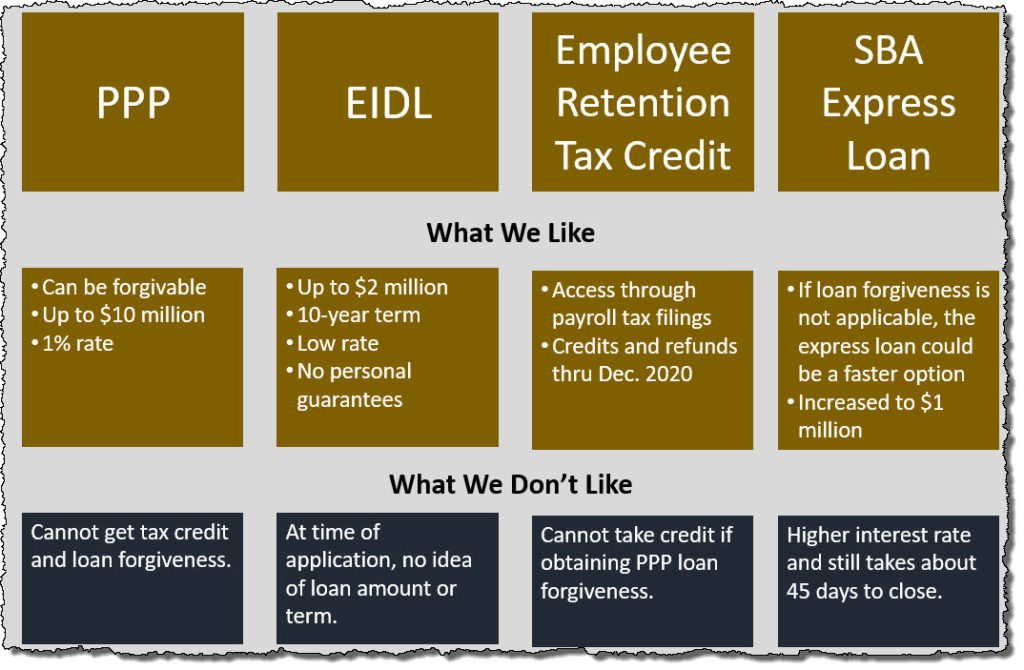

- Payroll Projection Program (PPP)

- Economic Injury Disaster Loan (EIDL)

- Employee Retention Credit under CARES Act

- SBA Express Loan – reach out to your current financial institution or find an SBA Preferred Lender

More Relief Not Mentioned Above or in the Podcast

If you already have a 7(a), 504, or microloan balance, the SBA will automatically pay the principal, interest, and fees for a period of six months. This also applies to all new loans under these programs issued before September 27, 2020.

What About non-SBA Loans?

I’m hoping you approached your lender on your existing loans by the first or second week of March.

Do not hesitate to ask for an interest-only loan payment for all indebtedness for the next 6 months.

Does your LOC renew within the next 90 days? Unless your revolver renews in the next 30 days, your lender cannot commit to a renewal. However, seek assurances as best as possible. Keep that lender in your crosshairs up to 30 days before renewal. Be prepared to show your action plans for being able to service the LOC.

Slightly Dated News

Bruce and I recorded our show on April 3rd around 9:45 a.m. central time. By end of day Friday, the PPP application had already been modified 3 times by the SBA. Plus, the SBA website says funds could be dispersed in about a week. Mark thought the timing would be longer when discussing with Bruce.

Leave a Reply