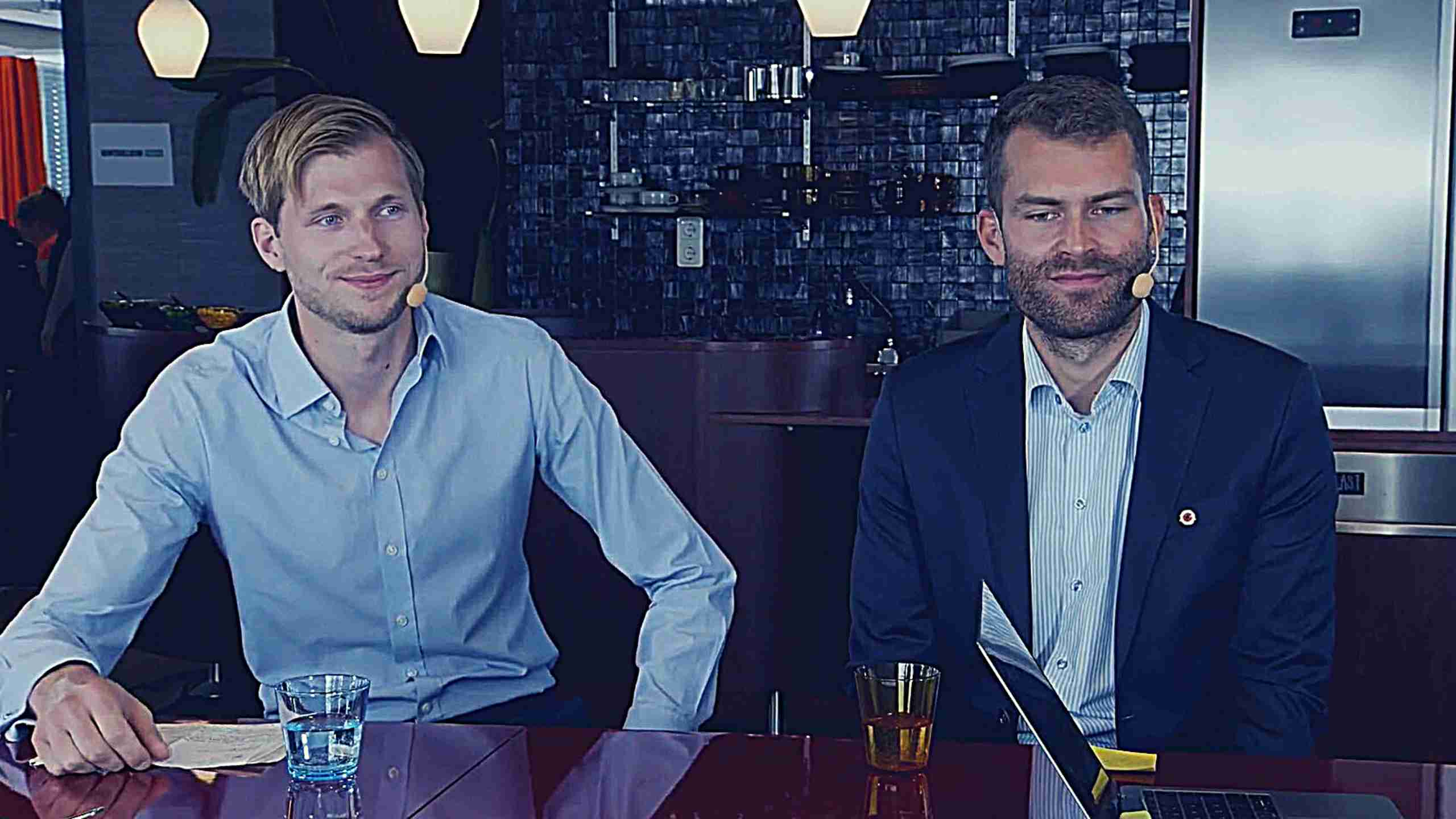

When I think of Dave Ramsey, the elimination of debt and whole life insurance policies quickly spring to mind. The syndicated radio host also touts his 8-12 rule for retirement. David McKnight joins the show to discuss these bold claims of Ramsey and other financial gurus based on his newest book, The Guru Gap. During this conversation, we also address annuities, Roth Conversions, cash basis insurance plans, social security, and the role of cheap term insurance for young people.

Episode Highlights

- Mark’s belief that The Guru Gap should have been written years ago

- The origin story of David’s thinking on these retirement strategies

- Clark Howard, who?

- The fatal flaw in Dave Ramsey’s 8-12 Rule for Retirement

- A retiree’s greatest fear

- The intelligent way to solve longevity risk

- The reason behind the hate of annuities

- Mark’s conversion story to cash value insurance policies

- The basic mechanics of cash basis plans

- “Mark, it’s a bond replacement, not an equity replacement.”

- Two smart strategies on when to use tax-free cash from an insurance policy

- The role of cheap term insurance for young people

- When should a person start taking social security?

- Methods to reduce the cost of health insurance later in life

- Good health – the forgotten investment

- The best order to read David’s other books

- David’s favorite reads include The Psychology of Money and The Millionaire Next Door

The Guru Gap by David McKnight is a guide to understanding the shortfalls of guru-based retirement strategies. It will help you bridge the advice gap between you and a sustainable financial future.

Book Club Questions

The Guru Gap is the perfect book to read and discuss in a small book club setting. Below are a few questions to consider during the process:

- David mentions no fewer than four gurus who are media influencers. Do you follow any of these gurus? Do you like them? Why or why not?

- David states, “Any retirement approach that doesn’t account for the strong likelihood of higher future taxes is, by definition, inadequate and incomplete.” Why?

- David reminds us that an American retiree’s greatest fear is running out of cash during retirement. Is this the case for you? Did the author do his job in providing a simple latticework of ideas to address this fear?

- What is the best solution for addressing longevity risk?

- Ken Fisher hates annuities. Is this just good marketing and advertising on his part or lousy investment advice?

- Who is Larry Kotlihoff, and why is he worth studying?

- Mark’s advisor calls cash-based insurance policies a bond replacement with benefits. Is that an accurate description of whole or universal life products?

- The author suggests two ways cash value could be used in retirement. What do you think? Do you have other ideas?

- What is a Piecemeal Internal Roth Conversion, and what are the benefits?

- Near the end of the book, David addresses the g0-it-alone approach. Do you agree? Or do you like Mark’s approach of reading David’s books and finding an advisor like David to use as a sounding board to develop a retirement playbook?

… the fact that the retirement advice they (the gurus) dispense tends to be good for bad investors and bad for good investors. If you’re a sophisticated, disciplined investor, adopting these gurus’ strategies could cost you hundreds of thousands of dollars, expose you to a vast array of retirement risks, and force you to run out of money years in advance of life expectancy.

The Guru Gap by David McKnight, page 136

Learn More About David McKnight

- Personal Website

- The Power of Zero for Financial Advisors

- David’s podcast

- LinkedIn profile

- Facebook business page

- YouTube channel

| Product Image | Product Name / Primary Rating / Price | Primary Button |

|---|---|---|

|

||

|

||

|

||

|

Episode Pairings

Leave a Reply