I recently visited with the most ethical and grounded financial leader I’ve ever known. He was well-versed in the CARES Act and was carefully studying the possibilities of securing PPP funding for his company. There was a glitch.

Disqualified

As we continued the conversation, he learned of a problem, and his company’s management would not qualify for PPP funding.

His company is owned by a private equity firm. That put them over the 500 employee threshold.

This Loan Request is Necessary

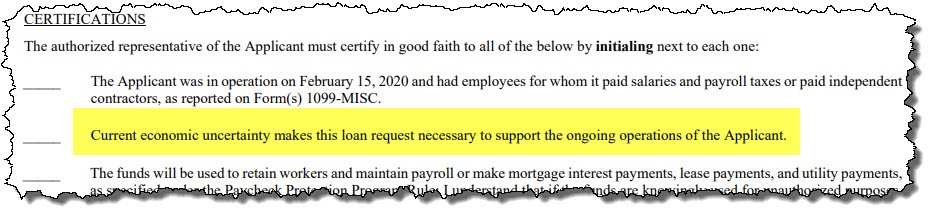

Our conversation turned to another important matter in the PPP process – certifications such as the one I’ve highlighted below:

One client completed a PPP application that should have never applied. That’s because they had to furlough staff and might need to shutter the business for a few weeks. If they want 100% forgiveness of the loan, they’ll need to hire everyone back for the entire ‘covered period’ as outlined by the Cares Act. By accepting the funding, they will probably sink into a deeper financial sinkhole.

I have other clients who have suffered from 50 to 90 percent sales drops. They’ve kept their staff in place. They need the money and will use it wisely–towards payroll, one of the allowable and forgivable costs.

In these cases, the operations of all companies are in question. Funding is critical. Certifying the highlighted section above required no second thoughts.

Everybody Else

Here’s my concern. Are there businesses accepting the funding that have not been impacted by the pandemic?

If so, what was their justification in certifying that current economic uncertainty makes this loan request necessary to support the ongoing operations of the applicant?

Is the lender the proper police for auditing this statement? Not when they are getting a percentage of the loan paid by the SBA to fund and process these loans.

Do Core Values Really Matter?

I have no idea how many businesses will receive PPP funding not needing this manna from heaven. I just ask one thing of those CEOs who signed the form. Do your firm’s core values match the certifying statement you are initialing? No rationalizing.

Filing the PPP with the bank is far more than an administrative financial act. For some owners and CEOs, it’s an ethical and moral exercise.

By the way, for the person who emailed me asking if they could use this money toward an owner buyout, I think you have your answer (again).

Leave a Reply