Weekly Bookmarks

64th Edition – April 26, 2020

We’ve seen FOBs survive economic losses, fires, tornadoes, threats, and deaths. We have never seen an FOB survive heirs who lack ambition.

Kathy Kolbe and Amy Bruske – Business is Business

1. The Best Business Book about FOBs I’ve Ever Read

I’m finishing my second reading of Business is Business by Kathy Kolbe and Amy Bruske which was released in 2017.

As I’m nearing the end, this book is not aimed for only family members. Employees working for family-owned businesses will gain valuable insights about some of the nuances family leaders deal with daily. If you read and like it, consider giving your marked-up copy to the family owner.

2. Beyond Budgeting is Beyond Boring, But …

I felt vindicated about my distaste for annual budgets dating back to the early 1990s when I read Bare Essentials: The ALDI Way to Retail Success (2004). Aldi does not waste its time on annual budgets.

While I applaud the work of the Beyond Budgeting Rountable, Hope’s and Fraser’s book, Beyond Budgeting is painfully dry, boring, and stale.

While the message is pillar content for any financial executive, start with the Beyond Budgeting principles on YouTube. For example, here are the first three principles:

3. Taking Advantage of Mutual Fund Losses During COVID-19

I probably take asset allocation to the extreme in my Vanguard accounts (and this may apply if you use Fidelity, Schwab, and other financial firms for building long-term wealth).

For those of you with moderate to large positions in after-tax funds, consider the article by one of my favorite personal financial blogs, The Whitecoat Investor who published Tax Loss Harvesting at Vanguard – A Primer in 2018.

This timely article even addresses how you avoid wash-sale rules when you re-invest the cash after taking a loss. Also, don’t let the title throw you – it applies to any fund family.

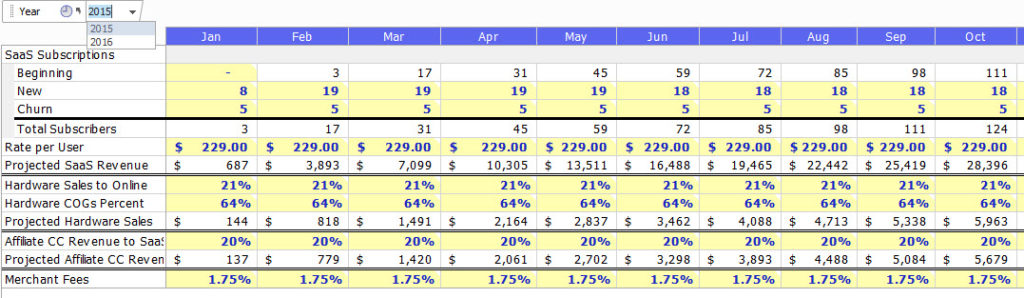

4. Never Forget the Five Ws of Financial Modeling

Most of the articles and courses on financial modeling focus on the technical aspects of building the tool and can be Excel-intensive. Qualitative requirements are mostly missing such as:

Why – what is the ultimate purpose of the model you are building which determines the level of detail and breadth of the model?

Who – who is the intended audience? CEOs want brevity. Bankers want a blend of brevity and depth. Operations managers need driver-based detail.

What – once you can clearly answer the first two Ws, you can start pruning what you do not need from the model. Model builders instinctively try to build into much detail.

Where – will this model be available on-demand? Then you’ll need more annotations and instructions for using the model. Is it for show-and-tell, then rehearse how you will present ahead of time?

When – is your company a practitioner of continuous business planning? Then make sure you have nailed down your cadence of model updating whether it’s weekly or monthly.

5. My Latest Fiction Read

According to an HBR article a few weeks ago, reading literary fiction helps people develop empathy, theory of mind, and critical thinking.

However, many business visionaries only recommend non-fiction. The article states that Bill Gates mentioned only 9 fiction titles out of 94 books he recommended over a 7-year period.

I force myself to read 3-4 classics in the fiction genre annually. If you need an idea, I just finished the audio version of The Book Thief. Charming, sad, inspiring, and will lead to several powerful emotions coming out of dormancy as you read or hear certain parts of the book.

This Week’s Podcast

Brian Jones of the Table Group joins us to talk about organizational health on this week’s show.

Recent Bookmarks – 63 | 62 | 61

Thank You For Reading

If you like the content above and the posts at CFO Bookshelf, may I ask a favor? Feel free to share this with other readers along with commenting on your favorite blog posts on LinkedIn, Twitter, or Facebook.

Take care and stay confident and strong this week. Always be learning and growing in times of hardship.

Title Photo by Kathy Sunderman – License

Leave a Reply