Weekly Bookmarks –

164th Edition – June 10, 2024

Since building and selling a business can take years or even decades, you can exactly practice exiting your business.

Dan Andrews

1. Remembering Studebaker

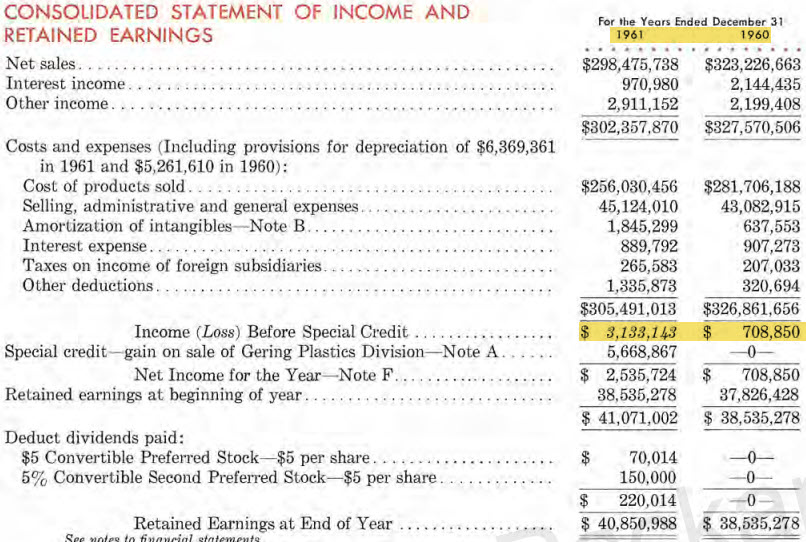

My, my, my. Once upon a time, financial reporting was kinder and gentler to the investor. After reading Brett Gardner’s excellent book on Buffett, I wanted to dig into some source material by looking at some old Studebaker financials (Buffett once invested in Studebaker).

Their 1961 report is only eleven pages long, with just two pages of note disclosures. While I appreciate the simplicity, critical information is missing. Based on Brett’s research, there is no reporting or analysis on their operating divisions, which was a frustration for Buffett.

2. The End of Accounting

The only place you’ll find the end of accounting is on a book title, and it is one that I recommend.

I would enjoy hearing what Baruch Luv says about that 1961 report mentioned above. In The End of Accounting, he states that financial performance does not indicate future success and that today’s reporting requirements are too tedious and cumbersome for investors to understand. He has different reporting in mind:

Our proposed disclosure to investors is primarily based on nonaccounting information, focusing on the enterprise’s strategy (business model) and its execution, and highlighting fundamental indicators, such as the number of new customers and churn rate of Internet and telecom enterprises, accidents’ frequency and severity—as well as policy renewal rates—of car insurers, clinical trial results of pharma and biotech companies, changes in proven reserves of oil and gas firms, or the book-to-bill (order backlog) ratio of high-tech companies, to name a few fundamental indicators that are more relevant and forward-looking inputs to investment decisions than the traditional accounting information, like earnings and asset values, conveyed by corporate financial reports.

Lev, Baruch; Gu, Feng. The End of Accounting

The End of Accounting and the Path Forward for Investors and Managers shows how the ubiquitous financial reports have become useless in capital market decisions and lays out an actionable alternative.

3. A Better Book on Exit Planning

At any time in my consulting portfolio, at least one client is contemplating an exit. I used to recommend Built to Sell to these owners. Today, I recommend Before the Exit by Dan Andrews.

Dan quotes Bo Burlingham, who says that half the owners selling their businesses did not enjoy the process. This book helps to plan for the exit and what to do afterward.

Whether you are still in the early stages of building or thinking of selling your business, this book is designed to help you build with the future in mind.

4. The Outsider Who Changed an NFL Football Team

I enjoyed a WSJ article about Howie Roseman, the current general manager for the Philadelphia Eagles. My favorite part of the story is that he had no football background. He inundated NFL front offices with letters until one gave in and offered him a job.

As I read the article, I thought, “I’ve heard that narrative before.” The Daron K. Roberts, J.D. story is inspiring, energizing, and sprinkled with elements of surprise. Before Howie Roseman of the Eagles, there was Daron Roberts.

No dream job is impossible. Ever.

In the summer of 2006, author Daron K. Roberts was just one year away from earning a law degree from his dream school: Harvard. But that summer, in the throes of a clerkship at a Texas law firm, Roberts had a revelation—he wanted something different. Very different. Daron Roberts wanted to be an NFL football coach.

5. Financial Leadership

Financial leadership is one of the nebulus terms that sounds good, but what is it?

My favorite way to describe it is by stating that it’s more about guardrails and boundaries than direction. Warren Buffett states it best in this 1983 Berkshire Hatheway Annual Report:

We rarely use much debt and, when we do, we attempt to structure it on a long-term fixed rate basis. We will reject interesting opportunities rather than over-leverage our balance sheet. This conservatism has penalized our results but it is the only behavior that leaves us comfortable, considering our fiduciary obligations to policyholders, depositors, lenders and the many equity holders who have committed unusually large portions of their net worth to our care.

Recent Bookmarks 163 | 162 | 161

Thank You

Thank you for reading. If you like the content above and the posts at CFO Bookshelf, may I ask a favor? Feel free to share this with other readers and comment on your favorite LinkedIn, Twitter, or Facebook.

Take care, and have a great week. Always be learning.

Leave a Reply