Monthly Bookmarks –

160th Edition – February 25th, 2024

In my whole life, I have known no wise people (over a broad subject matter area) who didn’t read all the time—none, zero. . . . You’d be amazed at how much Warren reads—and at how much I read. My children laugh at me. They think I am a book with a couple of legs sticking out.

Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger

1. Apple’s Impressive Financial Run

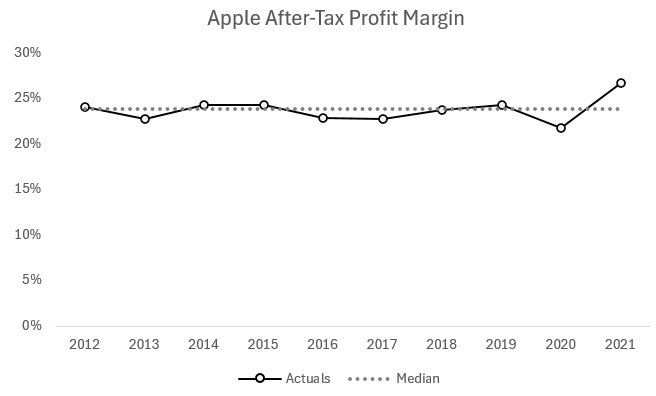

I just finished Warren Buffett: Investor and Entrepreneur by Todd Finkle, and one table in the book caused me to pause and reflect on Apple’s profit margins over ten years. Here is what their historical performance looks like:

I find that consistency both impressive and surprising. I would have guessed the performance to be in the middle teens. Even during COVID, the profit margin dipped slightly under 22 but quickly rebounded to a 10-year high the following year.

2. Was Munger’s Opinion on Financial Models Correct?

Todd devotes an entire chapter to Charlie Munger in his book on Warren Buffett. I was not aware of this mindset on financial analysis and modeling:

“Neither Warren nor I have ever used any fancy math in business, and neither did Ben Graham, who taught Buffett. Everything I have ever done in business could be done with the simplest algebra and geometry and addition, multiplication, and so forth. I never used calculus for any practical work in my whole damn life.”

Warren Buffett: Investor and Entrepreneur (p. 80)

I also find it hard to believe when he says, “he has never seen his partner perform a formal discounted cash flow analysis.” The author thinks he does this math in his head. I have my doubts about that, too.

3. Buffett Was Not Shackeled By the Sunk Cost Fallacy

Todd includes numerous examples of failed investment decisions by Buffett. Examples include investments in the airline industry, Sinclair Gas Station, Salomon Brothers, and numerous others.

But it never appears that Buffett threw good money after bad as those investments kept spiraling downward. He seemed immune from the sunk cost fallacy.

Incidentally, one of the best descriptions of sunk cost I’ve ever read is from Executive Economics by Shlomo Maital:

One reason bad projects die a hard death is because of the pervasive influence of sunk costs. Sunk costs measure money that has already been spent, but rather than treating it as water under the bridge, executives often pretend that they can and will recover revenues from them. They refuse to let go, becoming captives of spent money which is only a part of history and of no relevance in the present and future. Sunk costs are utterly without relevance for forward-looking decisions that ask, as they should.

Maital, Shlomo. Executive Economics: Ten Tools for Business Decision Makers (p. 37)

4. I Was Duped

The authors of The Invisible Gorilla end their book with how a private company CEO in a high-tech firm hired his first CFO, Jane Flynt. She had never been the head of finance at a large company.

… we needed to have a CFO in place for the next board meeting, which was coming up fast, but I was traveling to see customers most days of the week back then. So I had them come in on a Sunday morning.

The four candidates on the short list duly showed up at 9:00 a.m., in their Sunday best. As a final “test” in the interview, Taylor (the CEO) handed out laptops with PowerPoint installed and asked each candidate to prepare and deliver a five-minute presentation on why he or she should be chosen as Chimera’s new CFO. And he told them that they had to deliver their presentations to him and to the other candidates, in the company boardroom.

Chabris, Christopher F. . The Invisible Gorilla: And Other Ways Our Intuitions Deceive Us (pp. 225-226)

I love the idea, but the story is fabricated. This section was part of a longer fake CEO profile created by the authors to mimic similar articles they had seen in the press to summarize the six illusions they explained in the book.

My rating is 4.5 for readability, entertainment value, and instructive insights on how the brain works. The authors are the psychologists behind the famous gorilla experiment.

5. Sneaker Wars

I recently watched Adidas Vs. Puma: The Brother’s Feud on Amazon Prime. I had no idea that Puma was founded by one of the brothers behind the shoemaker, Adidas. Both brands are still located in Herzogenaurach, Germany.

One of the film’s memorable moments was the founder suggesting that Jesse Owens wear Adidas during the 1936 Munich Olympics. We know that Owens won four gold medals. Did the shoes make a difference?

I still want to learn more about this rags-to-riches entrepreneurial story. After watching the movie, I ordered Sneaker Wars by Barbara Smit, and I’m looking forward to reading about the family feud that impacted the sporting goods industry. Unfortunately, the title is only available in hardcover and paperback if you are a digital-only reader.

Recent Bookmarks – 159 | 158 | 157

Looking for a podcast episode from CFO Bookshelf? Here are five of our favorites:

- The Six Pillars of CEO Excellence (Carolyn Dewar)

- Outcome-based OKRs (Ben Lamorte)

- Revisiting WorldCom’s Financial Statement Fraud

- A New Way to Think With Roger Martin

- Why Are KPIs So Hard To Figure Out? (Bernie Smith)

Would you like to write a book review? Let me know on LinkedIn.

Thank You For Reading. Thank you for making this a successful newsletter.

If you like the content above and the posts at CFO Bookshelf, may I ask a favor? Please let others know on your social media platforms what you are learning from CFO Bookshelf.

Always be learning and growing.

Leave a Reply