In the next four years, CEO, author, and private equity expert Adam Coffey will create $2 billion in new wealth for his investors through just 6 initiatives with only a small team while maintaining a great culture of 3,000 employees. Adam is also the author of The Private Equity Playbook. In this episode, Adam breaks down the basics of private equity funds.

Adam’s Technical Background

- Started career with GE as an engineer after time in the service

- Thankful for education at GE’s Crotonville Management Training Center

The Growth of Private Firms is Staggering

In Adam’s book, he mentions that there were only 312 private firms in 1990. By 2017, that count swelled to nearly 5.4 thousand with $2.8 trillion under management. Those numbers continue to grow.

Adam pointed out that the image you may have of private equity firms is not the multi-billionaire raider trying to make as much money as possible at the expense of others.

Adam’s experience has always been in environments where culture and people are a focal point.

Other Show Highlights

- The average PE fund can generate about 14% over a 10-year life. Top firms are around 23%.

- PE firms are not liquid.

- Firms with generally longer time horizons include family-owned offices and self-managed funds.

- The 66-34 rule for CEOs.

- Don’t sell your business once, but twice – take a second bite out of the apple.

- Key financial terms – IRR, MOIC, and DPI

- What happens to excess cash in a portfolio company?

- The average holding period for a portfolio company.

- PE firm purchases can take as few as 23 days.

- The four pillars of due diligence – legal, finance, HR, and operations.

- Typical multiples a PE firm pays for an acquisition target.

- Margin Expansion vs Multiple Expansion.

- The Role of Consultants (the bend the curve faster than he can).

- SWIPE – steal with integrity, pride, and enthusiasm.

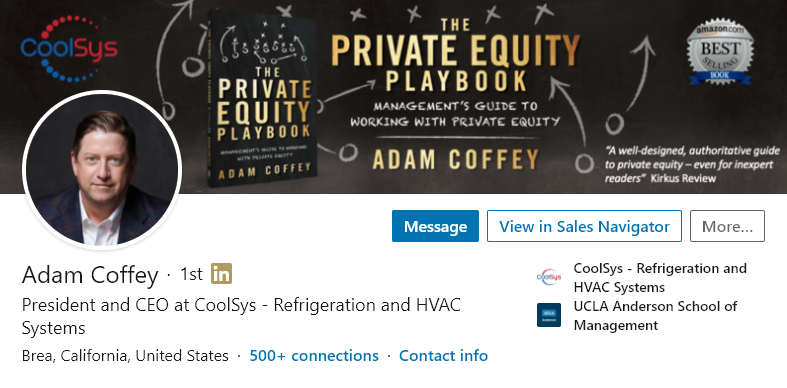

Don’t forget to buy Adam’s book. Both Mark and Bruce have read it (Mark has read it 3 times). They highly recommend it.

The author spent 20 years building a wildly successful private-equity-backed business, and he saw an education void on this topic. That’s why he wrote The Private Equity Playbook: Management’s Guide to Working With Private Equity.

Adam’s Favorite Books

One of Adam’s favorite authors as a CEO is Sandy Ogg, an operations expert with a deep HR background. Two of his books include Grow: The CEO’s Master Playbook for Coaching Value into Existence and Move: The CEO’s Playbook for Capturing Value.

For entrepreneurs, Adam likes the 2010 classic, The Millionaire Next Door, by Stanley and Danko and The Millionaire Mind.

Two New Books Coming Out

We don’t have all the details yet, but Adam has two new books coming out. I suggest following him on Amazon and then connecting to him on LinkedIn to stay updated- yes, he will accept your connection. Just tell him who you are and how you learned about him. I’m even betting he’ll answer a question or two for you.

Thanks for having me on the show Mark! I hope your listeners enjoy and benefit from our discussion! By the way – safe bet – I absolutely accept connections on LinkedIn and I am happy to answer listener questions! (fyi – website showing below is coming soon!)

Adam, thank you very much!

Again, a pleasure to have had you on the show. Great book, great conversation, and I hope to be your first customer of your next book.